How To Start A Consulting Firm Business

Launching a finance consulting firm requires careful planning and execution. Here are the essential steps to get started:

1. Develop a Business Plan: A well-structured business plan outlines your vision, target market, services offered, and financial projections. This document will be crucial for securing funding and guiding your business strategy.

2. Identify Your Niche: Choose a specific area of finance to focus on, such as tax consulting, investment advisory, or corporate finance. Specializing helps differentiate your firm in a competitive market.

3. Legal Structure and Registration: Decide on a legal structure for your firm—whether it’s a sole proprietorship, partnership, or LLC. Then, register your business with the appropriate government authorities and obtain necessary licenses.

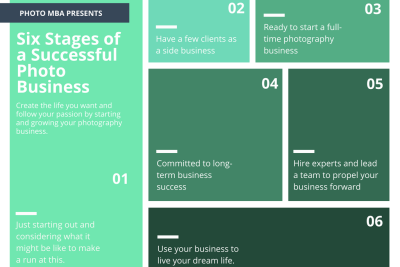

⬇️ Look Also How To Start A Photography Business

How To Start A Photography Business4. Create an Online Presence: In today’s digital age, having a professional website is vital. Your website should clearly outline your services, provide valuable content, and include contact information.

5. Build a Brand: Develop a strong brand identity, including a logo, color scheme, and messaging that resonates with your target audience. Consistent branding helps build trust and recognition.

6. Networking and Partnerships: Establish relationships with other professionals in the industry. Networking can lead to referrals and partnerships that enhance your service offerings.

7. Marketing Strategy: Create a marketing plan that includes both digital and traditional marketing strategies. Utilize social media, content marketing, and email campaigns to reach potential clients.

⬇️ Look Also How To Start A Airbnb Business Without Money

How To Start A Airbnb Business Without Money8. Set Up Operations: Determine your operational needs, including software tools, accounting systems, and client management processes. Efficient operations are key to delivering quality service.

9. Establish Pricing Models: Research the market to determine competitive pricing for your services. Consider whether you will charge by the hour, offer flat fees, or work on a retainer basis.

10. Compliance and Risk Management: Ensure compliance with regulatory requirements relevant to your consultancy. Implement measures to manage risks associated with financial consulting, including insurance and data protection protocols.

11. Client Acquisition: Develop strategies for attracting and retaining clients. Consider offering free initial consultations or workshops to showcase your expertise and build relationships.

⬇️ Look Also How To Start Real Estate Business Without Money

How To Start Real Estate Business Without Money12. Continuous Education and Improvement: Stay informed about the latest trends and changes in the financial sector. Continuous learning and professional development are essential for maintaining your competitive edge.

Following these steps will help you establish a solid foundation for your finance consulting firm, paving the way for future success.

How much does it cost to start a consulting firm?

Starting a consulting firm in the finance sector can vary significantly in cost, depending on several factors. Here’s a breakdown of the essential expenses you might incur:

1. Business Registration and Legal Fees:

- Registering your business can cost between $100 to $1,500, depending on your location and the type of business structure (LLC, Corporation, etc.).

- Consulting a lawyer for contracts and compliance can range from $200 to $1,000.

How To Start A Small Clothing Business From Home

How To Start A Small Clothing Business From Home2. Licensing and Certifications:

- If you need specific licenses or certifications (like CPA or CFA), the associated costs can be between $500 to $5,000 depending on the requirements in your jurisdiction.

3. Insurance:

- Professional liability insurance is essential and can cost around $500 to $2,000 per year, depending on your coverage needs.

4. Office Space:

- Renting office space varies greatly based on location but can average between $500 to $3,000 monthly. You could also consider co-working spaces to reduce expenses initially.

5. Marketing and Branding:

- Creating a website, business cards, and promotional materials can range from $1,000 to $5,000. Digital marketing efforts might require additional funds.

6. Technology and Software:

- Investing in financial software, accounting tools, and communication platforms can cost from $200 to $1,500 initially.

7. Operating Capital:

- It’s advisable to have at least 3-6 months of operating costs set aside as you build your client base. This could range from $5,000 to $20,000 depending on your specific overhead.

Overall, starting a financial consulting firm can range from approximately $8,000 to $50,000+, depending on how you choose to structure your business and the services you plan to offer.

Planning your budget carefully and considering your specific needs will help determine the final startup cost.

How do I start my own consulting business?

Starting your own consulting business in the finance sector can be a rewarding venture. Here’s a step-by-step guide to help you get started:

1. Identify Your Niche: Determine what specific area of finance you want to focus on. This could include personal finance, investment consulting, financial planning, accounting, or corporate finance. Understanding your niche will help you tailor your services effectively.

2. Gain Relevant Experience and Qualifications: Ensure you have the required credentials and experience in your chosen field. Consider obtaining certifications such as CFA (Chartered Financial Analyst), CPA (Certified Public Accountant), or CFP (Certified Financial Planner) if applicable.

3. Conduct Market Research: Analyze your target market and identify potential clients. Look into competitors and understand their offerings and pricing strategies. This will help you define your unique value proposition.

4. Develop a Business Plan: Create a detailed business plan outlining your business goals, target market, services offered, pricing, marketing strategy, and financial projections. A well-structured plan is essential for guiding your business and attracting investors if needed.

5. Set Up Legal Structure: Choose an appropriate legal structure for your business (e.g., sole proprietorship, LLC, corporation). Register your business name and ensure you comply with local regulations and obtain any necessary licenses.

6. Establish Your Brand: Develop a strong brand identity, including a professional logo, website, and marketing materials. Your online presence is crucial in attracting clients in today's digital age.

7. Network and Build Relationships: Connect with other professionals in the finance and consulting industries. Attend networking events, seminars, and workshops to build relationships that can lead to referrals and collaboration opportunities.

8. Create a Marketing Strategy: Implement a marketing strategy that includes online marketing (social media, content marketing, SEO) and traditional methods (networking, word-of-mouth referrals). Tailor your approach to reach your target audience effectively.

9. Set Up Operational Processes: Establish the systems and processes necessary for running your business efficiently. This includes client management, accounting, project management, and communication tools.

10. Deliver Outstanding Service: Focus on providing exceptional value to your clients. Build trust and credibility through your expertise and reliability. Satisfied clients are likely to refer you to others and become repeat customers.

11. Continuously Improve and Adapt: Stay updated on industry trends and continuously seek ways to improve your services. Gather feedback from clients and adapt your offerings based on their needs.

By following these steps, you can effectively launch your consulting business in the finance sector and set yourself up for success.

How profitable is a consulting firm?

The profitability of a consulting firm can be assessed through various metrics and factors. Here are some key points to consider:

1. Revenue Streams: Consulting firms typically generate income through project fees, hourly billing, or retainer agreements. The choice of revenue model significantly impacts overall profitability.

2. Profit Margins: The average profit margin for consulting firms can range from 15% to 30%, depending on their size, niche, and operational efficiency. Larger firms may have lower margins due to higher overhead costs, while specialized boutique firms can achieve higher margins.

3. Client Base: A strong and diversified client base can lead to consistent revenue and minimized risk. Firms that rely heavily on a few clients may experience volatility in profits if those clients reduce their spending.

4. Operational Efficiency: Effective management of resources, including staff utilization rates and cost control measures, plays a crucial role in a firm's profitability. High employee utilization often leads to increased billable hours and revenue.

5. Market Demand: The demand for consulting services fluctuates with economic conditions. During periods of growth, firms may see an increase in client budgets, while downturns create opportunities for cost-cutting and restructuring consulting services.

6. Specialization: Firms that specialize in high-demand areas (such as strategy, IT, or financial consulting) tend to command higher fees and thus can be more profitable compared to generalist firms.

7. Reputation and Brand: Well-established firms with a strong brand reputation often enjoy premium pricing due to perceived expertise, leading to higher profitability.

In summary, the profitability of a consulting firm is influenced by various factors such as revenue streams, profit margins, client diversity, operational efficiency, market conditions, and specialization. Proper management in these areas can lead to significant financial success.

Can consultants start their own business?

Yes, consultants can definitely start their own businesses in the finance sector. In fact, many successful financial consultants go on to establish their own firms after gaining valuable experience and insights from working with established companies. Here are several key points to consider:

1. Expertise and Skills: A strong background in finance, accounting, or business management is crucial. Consultants often possess specialized skills that can be leveraged to provide unique services.

2. Networking Opportunities: Building a robust professional network during consultancy work can lead to potential clients when starting a business. Connections made in previous roles can be extremely beneficial.

3. Understanding Regulations: The finance industry is heavily regulated. It's essential for consultants to have a firm grasp of compliance requirements, tax laws, and industry standards to avoid legal issues.

4. Identifying a Niche: Consultants can find success by identifying a specific niche market or underserved segment within finance, such as personal finance, corporate finance, or investment advisory.

5. Business Plan Development: Creating a detailed business plan is critical. This should include strategies for marketing, client acquisition, pricing, and operational structure.

6. Financing the Business: Having a clear understanding of initial costs and potential funding sources is vital. Consultants may need to consider options such as personal savings, loans, or partnerships to get started.

7. Building a Brand: Establishing a strong brand identity through marketing efforts and a professional online presence can help attract and retain clients.

8. Continuous Learning: The finance industry is constantly evolving, so staying updated with the latest trends, tools, and regulations is imperative for long-term success.

In conclusion, while it comes with its challenges, starting a business as a consultant in finance is not only possible but can also be a very rewarding endeavor if approached strategically.

What are the essential steps to start a finance consulting firm?

To start a finance consulting firm, follow these essential steps:

1. Define Your Niche: Identify the specific area of finance you'll focus on, such as investment management, tax planning, or financial planning.

2. Create a Business Plan: Outline your services, target market, competition, and financial projections to establish a roadmap for your firm.

3. Obtain Necessary Licenses and Certifications: Ensure you have the required qualifications and licenses to operate legally in your region.

4. Build a Professional Network: Establish connections with potential clients, partners, and other professionals in the finance industry.

5. Develop a Marketing Strategy: Promote your services through online and offline channels to attract clients and build your brand.

6. Set Up Operations: Organize your office, systems, and processes to efficiently manage clients and deliver services.

Following these steps will help you establish a solid foundation for your finance consulting firm.

How do I determine my target market for a finance consulting business?

To determine your target market for a finance consulting business, follow these steps:

1. Identify your niche: Focus on specific areas like personal finance, corporate finance, or investment strategies.

2. Research demographics: Analyze factors such as age, income, and location to define potential clients.

3. Understand client needs: Assess the common financial challenges faced by your target audience.

4. Evaluate competitors: Study other consulting firms to see who they serve and gaps in the market.

5. Create customer personas: Develop profiles of ideal clients based on your findings.

By focusing on these elements, you can effectively identify and reach your target market.

What legal and regulatory requirements should I consider when starting a finance consulting firm?

When starting a finance consulting firm, you should consider several legal and regulatory requirements:

1. Business Structure: Choose an appropriate business entity (LLC, corporation, etc.) and register it.

2. Licensing: Obtain necessary licenses and permits based on your location and services offered.

3. Compliance: Ensure compliance with financial regulations such as the SEC, FINRA, or other relevant authorities.

4. Insurance: Secure professional liability insurance to protect against legal claims.

5. Data Protection: Adhere to data protection laws like GDPR or CCPA if handling personal client information.

6. Reporting Requirements: Stay updated on financial reporting and disclosure requirements relevant to your advisory role.

Consulting a legal expert familiar with financial services is advisable.

Deja una respuesta